Mitsubishi joined Audi and Land Rover on Friday in holding new vehicles at ports in response to new automotive tariffs. A brand new report says unprocessed vehicles are starting to refill storage heaps at U.S. ports, and transportation employees say the backlog of vehicles may snarl transport logistics if nothing adjustments.

They Don’t Pay a Tariff (But) on a Automotive Held in Port

Why would an automaker refuse to select up its personal merchandise from ports? As a result of they don’t pay a tariff till they course of the automotive out of the port facility.

The Monetary Occasions explains, “Charges for holding vehicles in port are excessive, and carmakers are additionally in search of to maneuver autos into U.S. bonded warehouses, the place producers can quickly retailer merchandise with out being charged tariffs.”

Most Automakers Have Sufficient Stock for Now

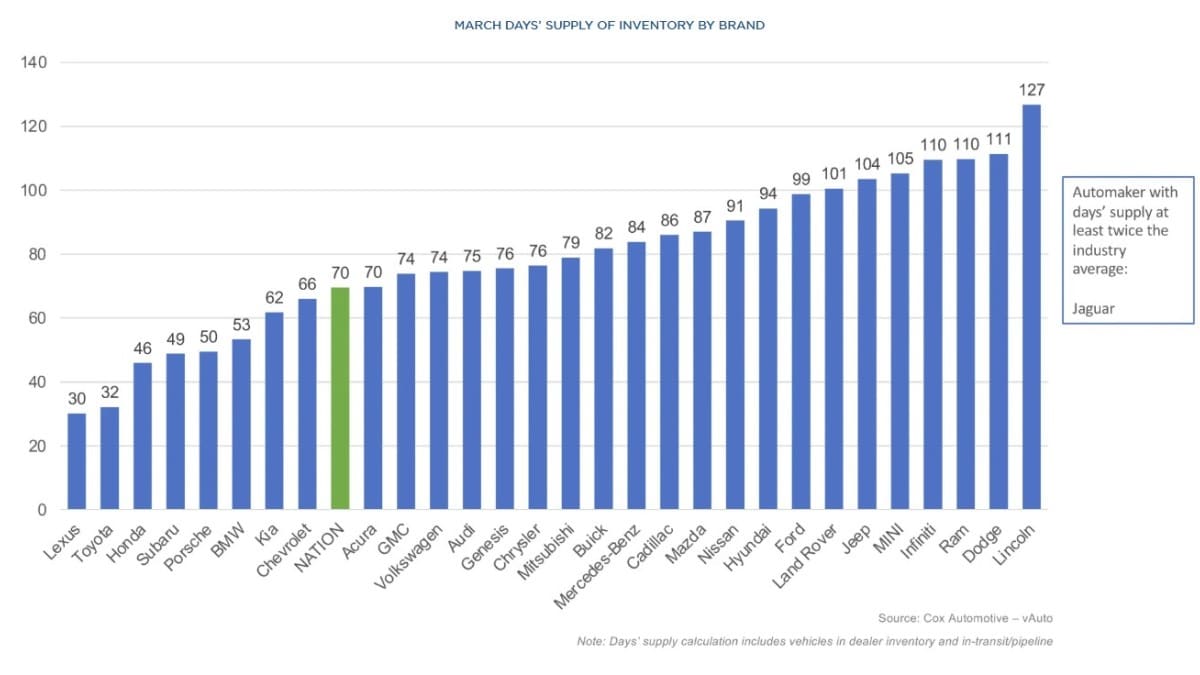

Balancing provide and demand is vital to automaker success. Most carmakers historically attempt to hold about two months’ price of vehicles on gross sales heaps at any given time, with one other two weeks in transit. Extra generally is a waste of cash (notably for sellers, who’re often making funds on the vehicles on their heaps). Fewer would possibly imply lacking out on gross sales as a result of they lack the mixture of colours and includes a purchaser needs.

The typical automaker entered this month with a 70-day provide — not removed from the goal. That’s shrinking as gross sales pace up. Many People have flocked to sellers in latest weeks, trying to purchase the final vehicles imported at pre-tariff costs.

Nevertheless, Land Rover and Mitsubishi are comfortably above that concentrate on. Audi is almost at it.

Mitsubishi spokesperson Jeremy Barnes instructed business publication Automotive Information, “We’ve enough inventory on the bottom at sellers for the second to not influence buyer alternative.”

Transfer May Repay if Tariffs Are Lifted

If the tariffs last more than stock, automakers should pay increased post-tariff costs to import the vehicles. However President Trump has already wavered on some tariffs, enacting a 90-day pause on non-car duties.

Corporations could be playing that Trump will waive the automotive tariffs earlier than they run out of stock.

Port authorities, nevertheless, are prone to begin objecting quickly. “We’re getting nearer to capability at some ports,” one nameless logistics govt instructed the Monetary Occasions. One other “warned that the piling of imported autos at American ports may get ‘fairly ugly’ with ports set to ‘refill quick’ in just a few weeks,” the FT stories.

Port employees are already bracing for chaos as deliberate port charges within the thousands and thousands of {dollars} per ship may quickly focus shipments into only a handful of already-busy ports, inflicting provide chain bottlenecks that might rival these of the early COVID-19 pandemic.